Nevada Lithium Exploration

"Fueling the Lithium Revolution"

- Prometheus Project

- Weepah Hills

- Clayton Valley

- Nevada Lithium

We are Nevada Lithium Exploration, Inc.

Nevada Lithium Exploration is at the forefront of the U.S. lithium boom, actively advancing exploration in one of the nation’s most lithium-rich regions—Esmeralda County, Nevada. Renowned for its extensive lithium-bearing claystone and brine deposits, Esmeralda County has become a focal point for critical mineral development. Our projects target high-potential zones near Clayton Valley and Lone Mountain, where recent drilling has revealed significant lithium concentrations. With a commitment to responsible resource development and a strategic location in the heart of the American Southwest, Nevada Lithium Exploration is positioned to play a vital role in securing domestic lithium supply for the clean energy future.

Exploration

Lithium mining in Nevada is gaining momentum as the state becomes a critical player in the global lithium supply chain.

Geology

The geology of Nevada, is renowned for its rich lithium deposits, primarily found in sedimentary claystone formations.

Staking & Claiming

Lithium mining in the United States, including in Nevada, is subject to a comprehensive framework of rules and regulations.

Technology

Controlled-source Audio-frequency Magnetotellurics (CSAMT) is a type of CSEM surveying in which the transmitter is placed in the far field from the receiver.

Geophysics CSAMT

Controlled Source Audio-Frequency Magnetotellurics (CSAMT) is a geophysical method used to investigate the electrical resistivity structure of the subsurface. It is a variant of the magnetotelluric (MT) technique, but unlike natural-source MT, CSAMT employs a controlled, artificial source to generate electromagnetic fields, typically in the audio-frequency range (1 Hz to 10 kHz).

In a CSAMT survey, a grounded dipole transmitter injects a known current into the ground, producing electromagnetic waves that propagate through the subsurface. At a distance sufficiently far from the transmitter (to approximate plane-wave conditions), electric and magnetic field components are measured at various stations. These data are analyzed to determine the apparent resistivity and phase, which can be interpreted to map geological structures such as faults, lithologic contacts, geothermal reservoirs, groundwater zones, or mineral deposits.

Required Tools

Mineral Localities

Choosing Location

Geo Survey

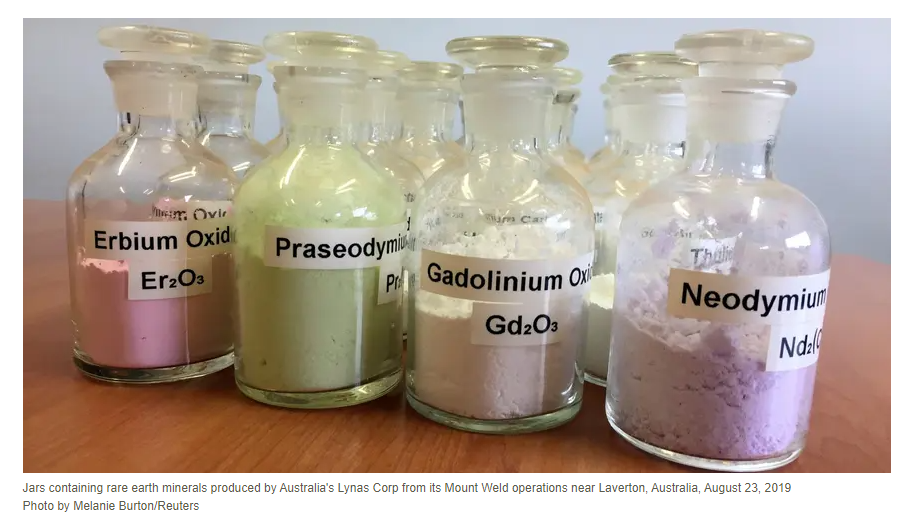

Rare Earth Metals

Esmeralda County, Nevada, is gaining recognition for its potential to host rare earth metals, critical elements that play a crucial role in modern technologies such as electric vehicles (EVs), renewable energy systems, defense applications, and electronics. While the county is primarily known for its rich lithium deposits, it is also emerging as a key location for the exploration and potential extraction of rare earth elements (REEs), which are essential for manufacturing high-performance magnets, batteries, and various electronic components.

Lithium Drilling

Come and meet Gary Bush the CEO of Nevada Lithium Exploration to discuss our Lithium Mining Project of 2025. He will be attending this event in Las Vegas, Nevada. The 17th Lithium Supply & Battery Raw Materials Conference is the industry’s largest and longest-running event, bringing together 1000+ delegates from 550 companies across 40 countries. It’s where the leaders forge partnerships, close deals, and tackle the critical issues and innovations shaping the sector’s future. With insights on supply-demand dynamics, pricing trends, refining tech, battery innovation, recycling and sustainability, this is the must-attend event for growth and data-driven decisions.

Explore

Nevada

Geo Mapping

Schedule

Links

About Us

Contact Us

News Releases

Get In Touch

- 810 Pony Express Rd. Cheyenne, WY 82009

- 877-685-4397

- info@nevadalithiumexploration.com